NEWS

1、Market overview

Global sales of consumer health products are expected to reach $322 billion in 2023, with an annual growth rate of 6% (at constant exchange rates, excluding inflation). In many markets, growth is driven more by inflation-induced price increases, but even without inflation, the industry is still expected to achieve 2% growth in 2023.

While overall consumer health sales growth in 2023 is expected to be broadly in line with 2022, the drivers of growth are significantly different. The incidence of respiratory diseases was extremely high in 2022, and cough and cold medicines hit record sales in many markets. However, in 2023, although sales of cough and cold medicines surged in the first half of the year, and this led to healthy sales growth throughout the year, the overall will be far below the level of 2022.

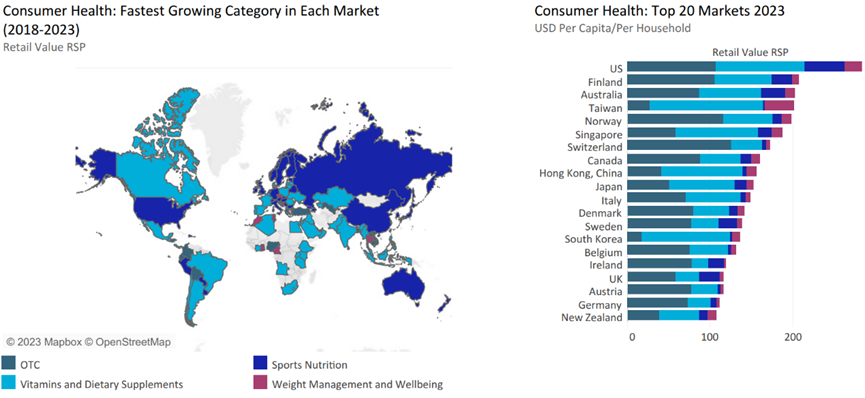

Left: The world's fastest growing consumer health category by market (2018-2023 retail sales)

Right: Top 20 Global Consumer health Markets in 2023 (average per person/per family, US $)

Source: Euromonitor International Passport database

By region, the spread of COVID-19 and other respiratory diseases, combined with consumer rush and hoarding, boosted sales of vitamins, dietary supplements and over-the-counter medicines in the Asia-Pacific region, helping the region easily grow at 5.1 per cent (excluding inflation), the highest growth rate in the world and almost double that of Latin America, the second fastest growing region.

Elsewhere, growth has been much slower, as overall consumer demand has declined and the scope for innovation has narrowed, particularly in vitamins and dietary supplements. This is most evident in North America and Western and Eastern Europe, where sales of vitamins and dietary supplements experienced negative growth in 2022 and are expected to continue to decline in 2023 (without inflation).

Over the next five years, when inflationary pressures ease, consumption will gradually return, with a rebound in all regions, albeit only marginally in some categories. The industry needs new vehicles for innovation to recover at a faster pace.

2、Category and brand

After the release of the epidemic control, Chinese consumer demand has increased significantly, making the sports nutrition category, which has been explosive growth for many years, a new level in 2023. There has also been a surge in sales of non-protein products such as creatine, which are marketed beyond fitness people with a larger health perspective.

In 2023, the outlook for vitamins and dietary supplements is uncertain, and the headline figure is not pessimistic because sales growth in Asia Pacific masks significant weakness elsewhere. While the need to boost immunity was a big boost to the category, the decline has continued and the industry is looking to the next wave of product development to drive new growth in the mid-2020s.

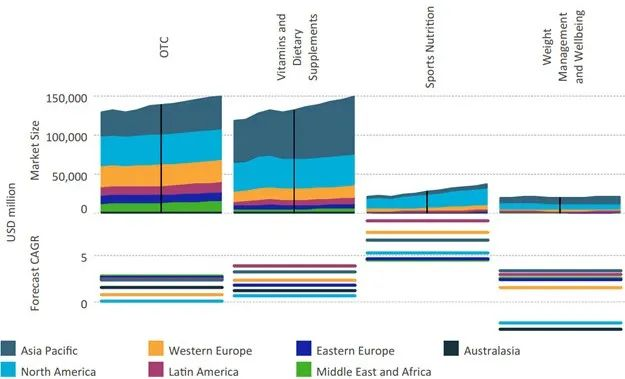

The scale and category growth rate of consumer health industry by region from 2018 to 2028

(Retail sales, million US dollars)

>

Source: Euromonitor International

Johnson & Johnson's spinoff of its consumer health business in May 2023 into a separate company, Kenvue Inc, is a continuation of the recent trend of divestitures in the industry. Overall, industry mergers and acquisitions have yet to reach 2010s levels, and this conservative pattern will continue through 2024.

3、Key trends

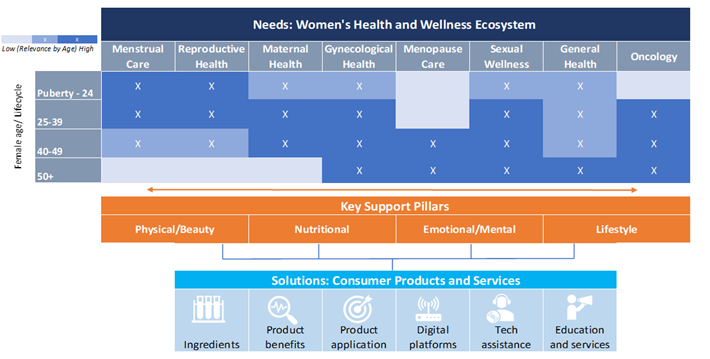

1. Women's health leads growth

Women's health is an area where the industry can refocus, with opportunities in over-the-counter drugs, vitamins and dietary supplements, sports nutrition, and weight management. In 2023, women's health related nutritional supplements increased by 14% in North America, 10% in Asia Pacific, and 9% in Western Europe. Companies in these areas have launched women's health products for every need and age group and cycle, and many have had great success in further switching and expanding from prescription to over-the-counter products.

Euromonitor International "Women's Health and Care Product Framework"

Acquisitions by major companies also reflect the attraction of women's health. When French consumer health company Pierre Fabre announced its acquisition of HRA Pharma in 2022, it highlighted the company's innovative OTC products for women's health as a key reason for the acquisition. In September 2023, it also announced its stake in MiYe, a French women's health care startup company. Unilever also acquired Nutrafol, a health care brand, in 2022.

2. Highly effective multi-functional dietary supplements

In 2023, the number of multifunctional compound dietary supplements that can meet multiple health needs continues to increase. This is mainly due to the desire of consumers to spend less when the economy is under downward pressure and to gradually think about their health in a more holistic way. As a result, consumers expect to see effective and efficient products that can effectively meet their many needs with just one or two pills.

3. Weight loss drugs are about to upend the weight management industry

The advent of GLP-1 weight loss drugs such as Ozempic and Wegovy is one of the major stories in the global consumer health community in 2023, and its impact on weight management and health product sales is already being seen. Looking ahead, while there are still opportunities for companies, such as guiding consumers to take these drugs intermittently, the overall picture is that these drugs will seriously weaken the category's future growth.

Source: Wegovy

4、Comprehensive analysis of China's consumer health market

Q: What is the development trend of China's consumer health industry since the orderly liberalization of epidemic control?

Kemo (Chief Industry Consultant, Euromonitor International) : China's consumer health industry has been directly affected by the COVID-19 epidemic in recent years, showing large market fluctuations and achieving rapid growth for two consecutive years, but the category performance is clearly differentiated. After the orderly release of epidemic control and control at the end of 2022, the number of infections rose rapidly, and sales of OTC products related to COVID-19 symptoms such as cold, antipyretic and analgesic products surged in the short term. With the overall downward trend of the epidemic in 2023, the sales of related categories also gradually fell back to normal in 2023.

Q: Are there any noteworthy categories in recent years?

Kemo: Since the outbreak began, in addition to the direct boost to sales of medicines such as cold and fever reduction, there has also been a significant increase in categories related to the symptoms of COVID-19. Among them, probiotics have become one of the most popular categories in the market in recent years because of their immune-enhancing effects. Coenzyme Q10 is well known to consumers because of its protective effect on the heart, attracting "Yangkang" consumers to buy, and the market size has doubled in recent years.

In addition, the change in lifestyle brought about by COVID-19 has also led to some health benefits. The popularity of home office, online courses and other forms has increased consumer demand for eye health products, and health products such as lutein and bilberry have achieved a significant increase in penetration during this period. At the same time, under the irregular rest and fast-paced life, nourishing the liver and protecting the liver is becoming a new trend for young people's health, driving the liver protection products extracted from thistle, pueraria and other plants to achieve rapid expansion on the online channel.

Q: What opportunities and challenges does demographic change bring to the consumer health industry?

Kemo: With the development of China's population entering a deep transition period, the demographic structure changes brought by fewer children and aging will also have a profound impact on the consumer health industry. In the context of declining birth rates and shrinking infant and child population, the infant and child consumer health market will be driven by the expansion of categories and the growth of parental investment in infant and child health. Continuous market education continues to promote the diversification of product functions and positioning in the children's dietary supplement market. In addition to traditional children's categories such as probiotics and calcium, leading manufacturers are also actively deploying DHA, multidimensional, lutein and other products that fit the refined parenting concept of the new generation of parents.

At the same time, in the context of an aging society, elderly consumers are becoming a new target group for vitamin and dietary supplements. Unlike traditional Chinese tonics, modern supplements have a relatively low penetration rate among elderly consumers in China, and forward-looking manufacturers have been successively launching products for the elderly, such as elderly multivitamins, etc., with the popularity of the fourth meal concept in the silver generation, this market segment is expected to usher in growth potential.

Article reprinted from: Euromonitor